Income Taxation is Slavery

I’ve been meaning to write about income taxation for a long time now. Almost a year ago I had written a letter on the issues of income taxation to the President of my country, H.E. D.D. Bouterse, for whom I incidentally also did the official portrait in 2010 after he was inaugurated. It is an open letter which was also published online for everyone to read. However, the original letter is written in Dutch (download), so I decided to translate it and post it here on my blog, instead of writing an entirely new article on income taxation specifically for my blog.

This letter is the result of years of personal research and experience, and I encourage you to not only read it thoroughly, but also to check out all the footnotes in their entirety. I can guarantee you that after doing that you will have learned a lot more about the world we live in than you might have been taught growing up.

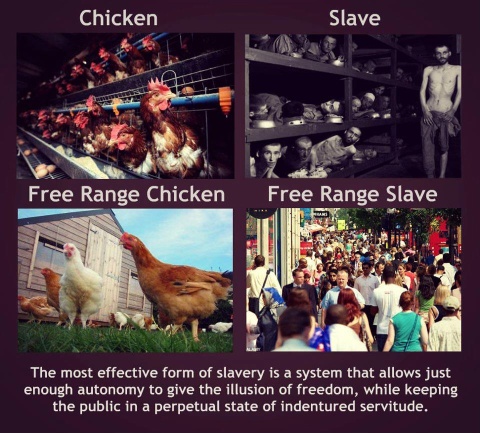

While most of the people in the world think they’re free, we are in fact very far from free. Slavery is still present everywhere around the world. The only thing that’s different is the way in which we are enslaved. Yes, people aren’t walking around in chains anymore, and countries have gotten their “independence.” But in reality what happened is that those in control have only moved away from a more in your face type of control and slavery, to a new kind where you think you’re free, but really aren’t. You see, when people think they’re free, there’s no reason for rebellion.

None are more hopelessly enslaved than those who falsely believe they are free. Johann Wolfgang von Goethe

But there’s one problem that they didn’t count on. In the new age that we are currently heading into where humankind moves into a higher state of awareness, no form of control and manipulation will be able to remain hidden, lies will be exposed and the truth will come out. So how exactly are we enslaved right now? Continue reading my letter below and find out.

Letter to the President

To: The President of the Republic of Suriname, H.E. D. D. Bouterse

CC: The Vice President of the Republic of Suriname, H.E. R. Ameerali

The Speaker of the National Assembly, Drs. Jennifer Simons

The Minister of Finance, Drs. Adelien Wijnerman

Dear President Bouterse,

Not so long ago Mrs. Jennifer Simons published a few questions on her Facebook page having to do with employment. Apparently it was found by some policymakers that there are insufficient workers available for the private sector and that most people prefer a job inside the government. I had responded to these questions through a “note” on my own Facebook profile, and I had sent you a copy of my response via email. 1 In this letter I want to dive deeper into one of the most important issues that we’re dealing with for many years, an issue that currently lies at the root of many problems in society, including the problem of employment. And that problem has to do with unfair taxation.

I’d like to indicate in advance that this is not intended as criticism of the current government, since we all know that this system is inherited from previous governments and that these issues have been present for years. Furthermore, I suspect that many of the issues that I will discuss are perhaps known to the government. I assume that the proposed fiscal changes shortly after you took office came for a good reason. Hopefully those changes are coming due to the fact that the government is aware of things that need to be improved.

Nevertheless I will share my opinion as completely as possible in this letter in the assumption that you may not be aware of this information.

One of the things that I frequently come across in my personal research in many areas is that for hundreds, and even thousands of years, humankind has had the knowledge to not only solve many problems in the world, but more importantly, to avoid those problems entirely. If we had made good use of that knowledge in all the time we’ve lost up until now, then the world would today be much closer to being a paradise. However, every time I have to conclude that although the knowledge exists to solve a great deal of the problems that we’re facing, there are groups of people who instead want to abuse that knowledge for their own benefit, in most cases at the expense of the vast majority of society.

It’s been known for at least thousands of years that unfair taxes eventually lead to the destruction of a civilization. “The power to tax is the power to destroy” people often say, and not without good reasons. In the book “The Income Tax: Root of all Evil” by Frank Chodorov, he writes: “The income tax is not only a tax; it is an instrument that has the potentiality of destroying a society of humans.” 2

There are indeed cases known in our history where the destruction of entire civilizations was the result of the negative spiral-effect in the economy caused by taxation (Ancient Egypt, Roman Empire etc.).

Egypt: “The most impressive analysis of Egypt’s demise came from the great Russian scholar Rostovtzeff. He believed, after a lifetime of study, that the decay in Egyptian society was the result of lawlessness in the bureaucracy, especially the tax bureau. The king could not restrain it and his orders went unheeded. Rostovtzeff felt that the continual and unabated tyranny of Egyptian tax collectors produced a nationwide decline in incentive. Egyptian workers and farmers lost their desire to work – agricultural lands fell into disuse, businessmen moved away and workers fled. Sound money disappeared as a raging inflation destroyed what capital there was. The land became filled with robbers who wrecked commerce and brought fear and despair to the populace. Boating and sailing along the Nile became as dangerous as walking at night on the back streets of New York and Detroit. In the end, thieves were no longer only in the tax bureau – they were everywhere.”

Rome: “The prevalence of crippling taxation prior to the fall of Rome has led many historians, in all ages, to suspect that Rome, like so many great empires, taxed itself to death. Recently, the tax theory of the Fall has become unfashionable among many scholars – perhaps because of our own tolerance for heavy taxation. No one likes to think we are writing our own obituary when we draft modern tax legislation. If our civilization is to be destroyed, we like to think it will happen Hollywood-style – a cataclysmic event like an atomic war, an ecological blunder, or some other dramatic happening. Certainly not something so simple and dull as everyday taxation.” 3

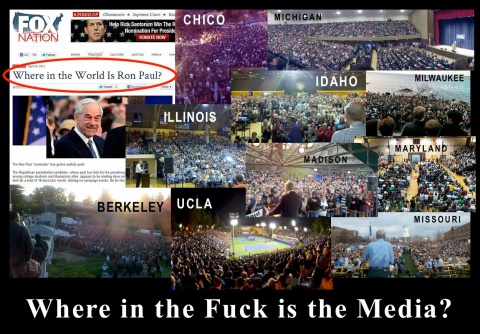

Today this can be seen in the USA where the economy is getting worse while the government continues to increase taxes. But even in Suriname we can notice the problems that continue to get worse as time passes. It’s absolutely no coincidence that increasingly more and more people in the USA are now calling for abolishing the income tax. The Republican Ron Paul, who’s also running for the presidential nominations in 2012 in the USA, has the income tax as one of his important issues. 4 This is one of the reasons why his popularity continues to increase and why he appeals so much to the younger generation in the USA and also the army. There’s also an anti-income tax movement in the USA right now that continues to grow.

It’s important to realize that taxation is one of the things that led to the American Revolution (1775-1783). (And I think that you can probably still remember the issues in the early 80’s in Suriname that were caused by tax increases). In America people were against the tax measures that Great Britain (British East India Company) wanted to impose on the colonies via the Townschend Acts. 5 One of the more known issues was the fact that due to financial issues, the British Empire had imposed taxes on tea in order to generate more revenue. This was met with heavy opposition by the Americans (Boston Tea Party) 6 and this was the start of the American Revolution. In retrospect, it seems strange that an entire revolution was started only because of a “small” tax on tea, as Frank Chodorov mentions in his book, 7 but it shows how much value the Americans attached to their freedom as human beings. Because, smart as they were, they could already see where this was leading to (their gradual enslavement by Great Britain through taxes). After having fought for their independence, the Americans ensured that the new American constitution of 1787 left no room for the introduction of an income tax, and they were very specific on the kind of taxes that would be allowed. However the “U.S. government” would later, by illegally passing the 16th amendment to the U.S. constitution 8 9, succeed in opening the way for the introduction of an income tax. This was only possible after the passing of two generations of Americans, when the American people finally started to “forget” what their ancestors had fought against in the period between 1775-1783. 10

It seems that humanity keeps forgetting its history and that as a result history keeps repeating itself. We keep repeating the same mistakes again and again, and use the same systems that ultimately lead to major problems and even to the end of entire civilizations. People often like to compare the USA of today with the Roman Empire hundreds of years ago and there are good reasons for that. The USA is heading off into a major economic crisis and ultimately the collapse of the entire economy because of the negative spiral effect of tax measures among other things.

The history of taxation is also the history of the rise and fall of civilization. It is the history of economic rape. 11

That we are currently stuck with income and payroll taxes in Suriname, despite all this knowledge of negative effects that they cause, is beyond my comprehension. How is it possible that we’re stuck with this in Suriname after so much history of obvious negative effects that will ultimately be disastrous for our society?

Even Albert Einstein clearly indicated that he had a huge problem with income tax when he said: “The hardest thing in the world to understand is the income tax.”

In a society where we may assume that we are all free individuals there is no room for an income tax. Because in fact it turns us all into slaves. 12

When the human is similarly deprived of what he has produced – which is the essence of income taxation – he is indeed degraded to the status of an ox. 13

Ron Paul calls it “involuntary servitude.” 14 Like he says: “An income tax is the most degrading and totalitarian of all possible taxes. Its implementation wrongly suggests that the government owns the lives and labor of the citizens it is supposed to represent.” 15

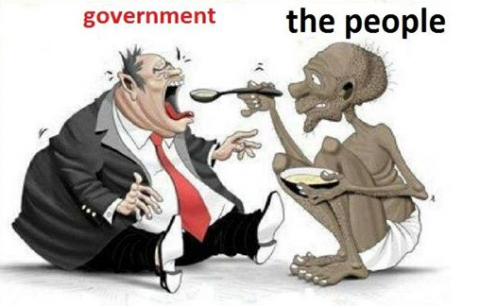

In other words, the income tax turns us into the property of the government, it turns us into slaves, when in fact the government is supposed to represent us, not own us. In our own constitution Article 15 says: “Nobody should be compelled to perform forced or compulsory labor.” However, through income and payroll taxes we are being forced to cede a portion of our income to the government, and in effect we are forced to work for the government.

Every person has the right to freedom and to life. Where as a free man you should have the right to be able to make a living for yourself so that you can survive, you are being forced to cede a part of your income to the government, and it doesn’t matter to the government if you get in trouble because of that and eventually can no longer meet your daily needs. The government determines how much of your income you can keep:

The government says to the citizen: “Your earnings are not exclusively your own; we have a claim on them, and our claim precedes yours; we will allow you to keep some of it, because we recognize your need, not your right; but whatever we grant you for yourself is for us to decide.” 16

And you have no choice in the matter – something that you’d expect to have as a free individual. You are required to pay, otherwise the government by intimidation and/or coercion and/or through the use of force, eventually still confiscates part of your income. This is in fact equal to stealing. Taking part of the income of citizens without their consent and against their will is theft. For years, stealing has apparently been completely legal for the government.

Tax is theft, legalized robbery, crime. Some people use intimidation, fraud, coercion, force, threat of force, violence, and terror to rob other people of their property, the fruit of their labor. Tax is economic rape. In the final analysis, tax is collected at the point of a gun. 17

The government can, under the law, take everything the citizen earns, even to the extent of depriving him of all above mere subsistence, which it must allow him in order that he may produce something to be confiscated. Whichever way you turn this amendment, you come up with the fact that it gives the government a prior lien on all the property produced by its subjects. 18

Ultimately we have no other choice but to pay, otherwise it happens by force. And you can’t say that you have a choice by not working if you don’t want to pay income tax, because then you die. That’s not a choice. This is why I say that we are all basically born as slaves. Slaves of the government and of this system.

Article 14 of our constitution says: “Everyone has a right to life. This right is protected by law.” By imposing a claim on the income of citizens, the government interferes with the right to life of every citizen. As Frank Chodorov very nicely explains:

The human being is the unit of all social institutions; without a man there cannot be a crowd. Hence, we are compelled to look to the individual to find an axiom on which to build a nonsocialistic moral code. What does he tell us about himself?

In the first place, he tells us that above all things he wants to live. He tells us this even when he first comes into this world and lets out a yell. Because of that primordial desire, he maintains, he has a right to live. Certainly, nobody else can establish a valid claim to his life, and for that reason he traces his own title to an authority that transcends all men, to God. That title makes sense.

When the individual says he has a valid title to life, he means that all that is he, is his own; his body, his mind, his faculties. Maybe there is something else to life, such as a soul, but without going into that realm, he is willing to settle on what he knows about himself-his consciousness. All that is “I” is “mine.” That implies, of course, that all that is “you” is “yours”-for, every “you” is an “I.” Rights work both ways.

But, while just wanting to live gives the individual a title to life, it is an empty title unless he can acquire the things that make life livable, beginning with food, raiment, and shelter. These things do not come to you because you want them; they come as the result of putting labor to raw materials. You have to give something of yourself-your brawn or your brain-to make the necessary things available. Even wild berries have to be picked before they can be eaten. But the energy you put out to make the necessary things is part of you; it is you. Therefore, when you cause these things to exist, your title to yourself, your labor, is extended to the things. You have a right to them simply because you have a right to life.

That is the moral basis of the right of property. “I own it because I made it” is a title that proves itself. 19

And further:

[…] your ownership entitles you to use your judgment as to what you will do with the product of your labor-consume it, give it away, sell it, save it. Freedom of disposition is the substance of property rights.

Interference with this freedom of disposition is, in the final analysis, interference with your right to life. At least, that is your reaction to such interference, for you describe such interference with a word that expresses a deep emotion: you call it “robbery.” What’s more, if you find that this robbery persists, if you are regularly deprived of the fruits of your labor, you lose interest in laboring. The only reason you work is to satisfy your desires, and if experience shows that despite your efforts your desires go unsatisfied, you become stingy about laboring. You become a “poor” producer. 20

It is silly, then, to prate of human rights being superior to property rights, because the right of ownership is traceable to the right to life, which is certainly inherent in the human being. Property rights are in fact human rights. A society built around the denial of this fact is, or must become, a slave society-although the socialists describe it differently. It is a society in which some produce and others dispose of their output. 21

It makes no sense to say that everyone has a right to life, when the government then proceeds to confiscate part of the income of every individual that is supposed to keep them alive, and as a consequence interferes with the right to life of everyone!! Personally I didn’t need Mr. Chodorov, or anyone else, to explain the above to me. From the very beginning I felt all of this deep inside me. I felt how unfair the system is, and I felt the harm that was being done to me, all of it against my will. And because of what I felt I started to investigate what was happening and I encountered all this information. I also learned that I am not alone and that there are many who also feel this way. I think almost everyone is feeling the same way. And yet today we are still stuck with this system, while there is sufficient information available about the disastrous consequences this has for each individual and for our society. And those disastrous consequences are clearly noticeable and will only get worse if this continues. History predicts where all of this will eventually lead to. There is only one possible end to this, and we still have the chance to put a stop to it.

Right now the problems in our society in Suriname are already very noticeable. We can see exactly the same things happening in Suriname that were present in Egypt thousands of years ago. People aren’t motivated to work and produce because they no longer have faith in this system. People realize that they are being heavily penalized by taxation and this has a negative psychological effect on everyone. Production is declining, and to compensate, the government increases taxes and this continues until the private sector gets completely destroyed and the middle class disappears in society. People don’t want to study (even though it may be free) because ultimately it’s pointless, employers don’t pay employees a sufficient salary because a higher salary also means more taxes to pay, and in the end it means their bottom lines suffer. The quality of services is declining because workers are not adequately trained and are not motivated to work for their low salaries. Most people find a job in government, where they do not have to worry about their performance and yet are assured of an income. As a result the government keeps growing and the need for more tax revenue to pay all those people also grows. Poverty, crime and corruption are increasing. The negative spiral effect is obvious. And again, there is only one possible end to this and history predicts it for us.

Apart from the fact that the income tax enslaves us and interferes with our right to life, in itself quite a serious problem already, there are many other problems that it causes in society, including the following examples:

- The income tax makes it difficult to save and live economically. People are encouraged to spend as much of their income as possible. The more of your income you hold onto, the more taxes you pay, and the more you will be penalized.

- The income tax punishes people who produce. Like Ron Paul says, “Taxing success is the worst thing you can do!” 22 Why should I be motivated to produce more and earn more money, when that just means that I will have to give more of it to the government (and especially government in its current form)? Basically we discourage people to produce because that means they will only get taxed a lot more! A very inexplicable situation. No wonder that Einstein couldn’t understand it.

Chodorov wrote the following about this:

What’s more, if you find that this robbery persists, if you are regularly deprived of the fruits of your labor, you lose interest in laboring. The only reason you work is to satisfy your desires, and if experience shows that despite your efforts your desires go unsatisfied, you become stingy about laboring. You become a “poor” producer. 23

The laborer is not stimulated by the prospect of satisfying his desires but by fear of punishment. When his ownership is not interfered with, when he works for himself, he is inclined to develop his faculties of production, because he has unlimited desires. He works for food, as a matter of necessity, but when he has a sufficiency of food he begins to think of fancy dishes, a tablecloth, and music with his meals. There is no end of desires the human being can conjure up, and will work for, provided he feels reasonably sure that his labor will not be in vain. Contrariwise, when the law deprives him of the incentive of enjoyment, he will work only as necessity compels him. What use is there in putting out more effort? 24

When we know this, why then does it surprise us that people aren’t motivated to work? And that people are not motivated to start their own businesses? No wonder people prefer to work for the government! Given a choice, they choose to be the exploiter rather than being the one that is exploited. And where do you think that this ultimately leads to? What do you think happens when eventually hardly anyone is motivated to produce, and would rather sit in the government and consume?

[W]hen it is no longer worth the producers’ while to produce, when they are taxed so highly to keep the politicians and their friends on the public payroll that they themselves no longer have a reasonable chance of success in any economic enterprise, then of course production grinds to a halt… When this happens, when the producers can no longer sustain on their backs the increasing load of the parasites, then the activities of the parasites must stop also, but usually not before they have brought down the entire social structure which the producers’ activities have created. When the organism dies, the parasite necessarily dies too, but not until the organism has paid for the presence of the parasite with its life. It is in just this way that the major civilizations of the world have collapsed. 25 Professor John Hospers, 1975

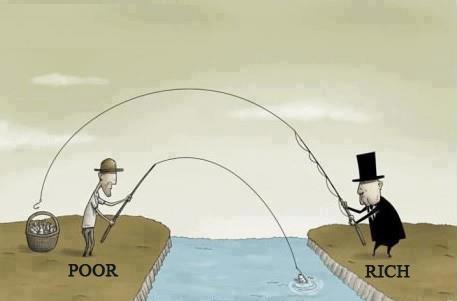

- The income tax is unfair, especially to the middle class and the poor. The impression is often given that the poor benefit more from an income tax because the rich pay more and thus contribute more. Nothing could be further from the truth.

- Income is confiscated from people who produce and given to people who don’t produce. There is confiscation in the private sector for the benefit of the public sector. The public sector only consumes. And the trend is that the public sector keeps growing as more people flee from the private to the public sector because of all the problems. So while consumption grows, production declines. The taxes keep getting increased because of the growing public sector. Companies can’t pay employees enough and often can no longer afford them. The middle class becomes impoverished until it completely disappears.

Tax is parasitism. It involves some people living as parasites off the production of others. Tax penalizes the producer and rewards the destroyer – it takes from the producer and gives to the destroyer. Over time this leads to destruction of production. 26

- The middle class and the poor have difficulty resisting taxation, while the rich more easily can.

- The rich can pay expensive accountants and tax advisors that enable them to circumvent taxes and get maximum benefits out of the system. The poor and middle class are unable to do so, and an attack from the tax bureau can be fatal for them.

- In addition, the rich are also able to use their power, wealth and influence to take advantage of the system, mainly because the system encourages corruption.

- It’s also the case that projects in the public sector can never be carried out by the poor, but only by the rich who own all the companies. So the tax money from the poor and the middle class flows to the rich elite through public sector projects and the government.

- Even while it may be the case that the rich pay more taxes compared to the poor, due to all of the above points they eventually get that money, and even more, back from the government.

- The result of all the above is that eventually the poor become poorer while the rich get richer.

- Income is confiscated from people who produce and given to people who don’t produce. There is confiscation in the private sector for the benefit of the public sector. The public sector only consumes. And the trend is that the public sector keeps growing as more people flee from the private to the public sector because of all the problems. So while consumption grows, production declines. The taxes keep getting increased because of the growing public sector. Companies can’t pay employees enough and often can no longer afford them. The middle class becomes impoverished until it completely disappears.

- The income tax is designed so that maximum benefit is achieved for the government. The government is primarily interested in confiscating as much money as possible from everyone, regardless of the negative impact on the victims and society in general.

- As an independent you’re only allowed to deduct a small part of the costs you incur as a result of illness from your gross income. This clearly indicates that the government couldn’t care less about whether you’re healthy or not. Not only that, but if you can pay your medical expenses you even have to pay taxes on those! Isn’t it strange that repair costs for equipment that you use for work may be deducted from your income as expenses, but that only a small portion of medical expenses may be deducted? Aren’t humans more important than their equipment? When you’re sick, you often can’t work. You would expect that the government would be happy that you can still provide for yourself and can ensure that you get better so you can start working and producing again. But instead the government even taxes you all while you’re incurring losses resulting from not being able to work (optimally). It’s like being able to pay for medical expenses is a luxury.

- There are more examples I could give but I won’t mention them to keep this letter relatively short.

- And to think of how the money is ultimately used. That’s what makes it even harder to accept. Money taken from the poor and hard working people is confiscated in such an unjust manner and paid to government employees who perform very poorly and basically aren’t even needed. To people in government who earn too much. To people who are placed on the public payroll through politics and corruption. To people employed by the government who are told to stay at home and still receive money for doing absolutely nothing at all. To friends of politicians who get various grants in the public sector. Does it then surprise you that many people think “I’d rather go work for the government?” Would you like to be the exploiter or the one being exploited? That is a question I have personally answered with “no” so far, but many (have no choice but to) say “yes”.

Mr. Ronald Hooghart recently wrote: “Another form of inflationary interference on the production level of society is the fact that at least 50 former ministers receive a top salary of almost SRD 10.000 monthly for doing absolutely nothing at all, and then we talk about ‘I LOVE SU’, that’s criminal. Then there are a large number of officials, with exemptions sitting at home while still receiving a monthly salary, nobody that’s saying anything about that, while the lower official who appears every day at work must defend himself if he makes even a small mistake. The law is unjust.” 27

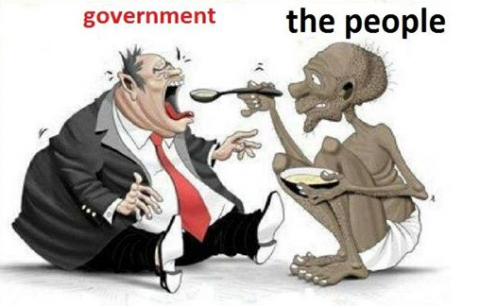

Government and the People

- The income tax enables the government to continue to increase its power. The government is supposed to represent the people and the power should be in the hands of the people, but instead we get the opposite situation. The government gets all the power and the people are dependent on, and slave of the government.

No kingship in the history of the world ever exercised more power than our Presidency, or had more of the people’s wealth at its disposal. We have retained the forms and phrases of a republic, but in reality we are living under an oligarchy, not of courtesans, but of bureaucrats. It had to come to that. The theory of republican government is that sovereignty resides in the citizen, who lends it to his elected representative for a specified time. But a people whose wealth is siphoned into the coffers of its government is in no position to stand up to it; with its wealth goes its sovereignty, its sense of dignity. People still vote, of course, but their judgment in the ballot booth is unduly influenced by handouts from their government, whether these be in the form of “relief,” parity prices, or orders for battleships. Though it is not exactly an over-the-counter transaction, the citizen’s conscience is bought. Nor are voters immune to the propaganda issued by the bureaucrats, in their own behalf, and paid for by the voters themselves. 28

Not only does the government have a claim on the income of the individual, and thus the individual himself, but the government can even influence the thoughts of an individual. An example of this is the way in which supporters of a political party are accommodated in the government in exchange for their support, as has been the case for years in Suriname. People are bribed by the government, and the government is able to do so thanks to the resources which they confiscate from the people.

- Furthermore, the government has another means to keep its citizens in check, namely the tax bureau. As Chodorov explains:

The composition of the ruling regime makes no difference; the Internal Revenue Bureau is a self-operating inquisitorial body. It has the means of harassing, intimidating, and crushing the citizen who falls into its disfavor. In the two cases cited the starting point was a difference of opinion on the correctness of a bookkeeping entry. The Bureau could have sued for the recovery of taxes, a civil case; it chose to bring the criminal charge of “willful evasion.” The Bureau has that choice. The tax laws are so intricate, and made more so by Bureau rulings and Tax Court decisions, that it is virtually impossible for an accountant to be sure his method of arriving at a taxable income, or his computation of the tax, is beyond question. The technicalities that the Bureau may bring up are legion. Therefore, whenever the Bureau has reason to “get” somebody it has ample means at its disposal. 29

And further:

Morally, tax is similar to a mafia protection racket – with the difference that the mafiosi operate in a simple, straightforward manner (“Pay up, or else!”); while tax collectors clothe their economic rape in high-sounding hypocrisy (“Pay your fair share!; for the good of society!; voluntary compliance!”). Tax laws, rules, and regulations grow in number and complexity to the point that any taxpayer can be prosecuted for being a tax criminal, no matter how much tax he or she pays. 30

Especially the latter case is applicable in Suriname today. Strictly speaking, almost the total population in Suriname could be harassed by the tax bureau in one way or the other, if the bureau wanted to and if they had all the information needed.

Over time, in every taxed society, tax collectors tend to become more vicious, violent, and criminal – eventually becoming a terrorist Gestapo. In every taxed society the tax system develops into a social control mechanism that is particularly used against “dissidents” and “public enemies” who can’t be otherwise neutralized. In every taxed society the justice system becomes closely linked with the tax system. Judges become corrupt tax collectors. The police becomes a criminal class. People lose all respect for “the law.” 31

And here’s another example of a few hundred years ago:

“At first, the Muhammadans came as liberators and brought relief to the inhabitants of an over-taxed and enslaved Roman world,” writes Adams, but finally: “The Moslems had led the world right back to where it was before they had arrived on the scene. Only the names had changed. Moslem tax men ended up rivaling the worst of the Roman Empire. Perhaps this picture of Moslem tax chiefs, written centuries ago, best illustrates the end-product of their tax system: ‘They were cruel rascals, inventors of a thousand injustices, arrogant and presumptuous… They were the scourges of their age, always with a causeless insult ready in their mouths. Their existence, passed exclusively in oppressing the people of their time, was a disgrace to humanity.'” 32

- The income tax stimulates corruption starting at the very base of society. It is easy to put the blame on the individual who ultimately decides if he wants to be honest or dishonest. But when we create such a situation in society where the livelihood and preservation of the people are at stake if they’re being honest, then we cannot blame anybody for being dishonest from time to time in order for them to survive. Because like I argued above, the income tax is actually an attack on our right to life. I will reiterate what Chodorov said:

[…] your ownership entitles you to use your judgment as to what you will do with the product of your labor-consume it, give it away, sell it, save it. Freedom of disposition is the substance of property rights. Interference with this freedom of disposition is, in the final analysis, interference with your right to life. 33

The choice that the government eventually gives to people is: do you want to be dishonest and live, or would you rather like to be honest and get disadvantaged, hurt and maybe even die? At first this seems extreme, but for many in society this isn’t as extreme as you might think because they’re confronted with this every day. The more you’re honest to the tax bureau, the more they drive you into the ground and the more you are disadvantaged, to the point that it becomes hard and maybe even impossible for you to make a living. And here I’ll let Chodorov do the talking again, since he described decades ago what we are dealing with today:

The corruption of freedom on the individual level is bad enough. But the corruption of freedom on a mass scale is worse. When the political establishment undertakes to undermine the integrity of the people as a whole, to weaken their power of resistance to authority, and even to lure them into an acceptance of it, then freedom has no leg to stand on. This is exactly what income taxation does, particularly with its exemption device. Bribery through exemption is a most insidious form of corruption.

The corruption of freedom is in proportion to the moral deterioration of the people. For a people who have lost their sense of self-respect have no need for freedom. And the income tax, by transferring the property of earners to the State, has disintegrated the moral fiber of Americans to such a degree that they do not even recognize the fact.

Due to the revenues from income taxation, the government is now the largest employer in the country, the largest financier, the largest buyer of goods and services; and, of course, the largest eleemosynary institution. Millions of people are dependent upon it for a livelihood. They lean upon the State, the one propertied “person,” even as a bonded servant leans upon his master. They demand doles and subsidies from it, and willingly exchange their conscience (as at the ballot booth) for the gift of sustenance. Wardship under the State, by way of unemployment insurance, public housing, gratuities for not producing, and bounties of one kind or another, has become the normal way of getting along; and in this habit of accepting and expecting handouts, the pride of personality is lost.

Moral deterioration is a progressive process. Just as a worn part of a machine will affect contiguous parts and finally destroy the entire mechanism, so the loss of one moral value must ultimately undermine the sense of morality.The income tax, by attacking the dignity of the individual at the very base, has led to the practice of perjury, fraud, deception, and bribery. Avoidance or evasion of the levies has become the great American game, and talents of the highest order are employed in the effort to save something from the clutches of the State. People who in their private lives are above reproach will resort to the meanest devices to effect some saving and will even brag of their ingenuity. The necessity of trying to get along under the income tax has made us a corrupt people. 34

Chodorov talks about the Americans here, but this is also 100% applicable in Suriname, and the rest of the world, in every country with an income tax. I say this not only because of the research I’ve done, but from my own experience and that of others here in Suriname that I’ve heard:

- It’s public knowledge that most people/companies maintain two financial administrations. A real administration for themselves, and one for the tax bureau. I have personally seen this at different businesses that are well known and very respected in society. Even software is developed specifically to take this into account and make it easier.

- Companies pay employees an official salary, which is disclosed to the tax bureau, and an additional amount thereon which is kept outside the books. If they don’t do that the payroll taxes become so high that they can’t retain the employees and would have to stop offering their services.

- There’s rampant corruption at the customs clearances. I have personally seen how money isn’t only offered below the table, but even above the table (while other waiting “customers” laugh and look on) only to avoid having to pay the high taxes so that people can survive in these increasingly difficult times. I had previously mentioned in my response to Mrs. Simons on Facebook 35 my personal experience where as an entrepreneur I was only disadvantaged even more while I was in fact already suffering losses. The government doesn’t care about this, since their only goal is maximum confiscation. So it doesn’t surprise me that people try to minimize the negative consequences of this for themselves. And not only does it not surprise me, but I can even understand them.

- Officials make a lot of arbitrary decisions at the tax bureau because the laws are very vague about many things. A lot often depends on which tax official you’re dealing with, and even worse, in what kind of mood he or she is on that day, in order to get to a more positive end result for yourself. Even tax advisors admit this. Because of the uncertainty, there’s more room for corruption and for officials to abuse their power, which is something that is very common. No wonder that people offer to pay them money in order to stay on their good side.

- I want to state very clearly that I am not judging anybody here. To me it’s obvious that it’s not the people who are the problem here, but it’s this system in which we live that corrupts every man at the very base. Again as Chodorov very clearly explains:

The income tax, by attacking the dignity of the individual at the very base, has led to the practice of perjury, fraud, deception, and bribery.

As a society we have to finally start admitting that all of us are responsible for creating a lot of these issues and we have to stop trying to combat the symptoms and instead focus on the root causes! We shouldn’t be making laws against corruption, or impose higher fines as if the people are the problem; instead we must make this system vanish from our society. Otherwise it’s already clear according to history what our fate will ultimately be, i.e. total destruction. Nobody is born a criminal; it’s our society and the systems that we use within our society that creates criminals.

- The income tax not only enables a “modern” form of slavery, as previously explained, but also enables a “modern” form of colonialism. We like to think that Suriname has been independent since 1975, but this is far from true. We’ve just made the transition from an obvious form of colonialism/slavery, one that everyone can see and can fight against, to a form of colonialism/slavery where people think they are free/independent but aren’t in reality. If you think you’re free, you have no reason to fight against your enslavement.

The way in which the rich countries do this is described by economist John Perkins in his book “Confessions of an Economic Hitman.” 36 (See interview in the footnote!) What happens is that these countries lend large amounts of money to developing countries to carry out various projects. They intentionally make the requirements to execute those projects very high, in order to ensure that the projects can eventually only be carried out by companies from the rich countries themselves (local businesses in the developing countries can’t comply with the high requirements). In this way much of the loaned money flows right back to their own country. However, the developing country is still left with a huge debt which must eventually be paid back with interest. And of course that debt is paid back with the taxes paid by the local population. They make it particularly difficult for developing countries to repay the debt and the debt continues to rise. The resources of such a country are then bought up cheaply in order to pay the debt. And this is the way in which the developing country is exploited. The only people in the developing country that benefit from this are usually a small elite that help set all of this up at the expense of the total population, the majority of which only becomes more impoverished.

This system to exploit the population via taxation is used by the IMF and was successfully implemented here in Suriname during the Nieuw Front government when the Structural Adjustment Program (SAP) of the IMF was implemented. Whether the government back then was sufficiently aware of what they were doing, or if they were manipulated by the IMF, remains open for discussion.In the period between 1992-1995 the government carried out a structural adjustment program. The main measures were a tax reform, devaluation of the Surinamese guilder and an assimilation of the different exchange rates. 37

In the first Protocol to the European Convention it states that no one may be arbitrarily deprived of his property, but that does not prevent a state to secure the payment of taxes. The imposition of a heavy tax burden could lead to involuntary servitude or slavery. In the context of structural adjustment programs, the IMF has often insisted on raising taxes in developing countries, which led to a lot of protests. The main problem in many (developing) countries however is not the amount of taxation, but the righteous collection thereof. It is especially the elite who can evade taxes. 38

Developing countries that got in financial trouble still had to turn to the International Monetary Fund for help in the eighties and nineties. Very often they got a structural adjustment program imposed on them as a condition to receive help. Its aim was to enable a country to repay its debts.

The countries always got monetary policies to implement which devalued their currency, government spending was drastically reduced and all economic efforts got focused on the export of goods.

These heavy cuts often had devastating consequences for healthcare, education and agriculture. In fact they required these countries to stop all socio-economic policies and to forget about social politics.

The big currency devaluation made life much more expensive and increased the debt in real terms. And when you impose these same policies on almost all poor countries, you put them all into a downward spiral of competition.

Flaming criticism on these policies of the International Monetary Fund came from Joseph Stiglitz, the Nobel Prize winner for economy in 2001 and former chief economist at the World Bank. Very convincingly he describes in his book published in 2002 titled “Perverse Globalization” how the IMF imposes the worst economic policies thinkable on many countries. The results are always a much deeper economic crisis than usual, a lot more unemployment, poverty and lost prosperity. 39The structural adjustment programs were imposed in the early 80s in exchange for new loans or for the rescaling of old loans by the IMF and the World Bank. This adjustment was to secure the resumption of repayments of the foreign debt of the country (the payment of interest and repayment of loans).

The structural adjustment in general relies on the following elements, in specific dosages:- devaluation of the national currency to reduce the price of export products and to bring in strong currencies for the repayment of the debt

- increase of the interest rate to raise international capital

- reducing public spending: layoffs in the public sector,

- reduction of budgets for health and research, etc.

- mass privatization

- reducing public subsidies for the operation of certain companies or certain products

- blocking of wages to avoid that the devaluation leads to an inflationary chain reaction.

The structural adjustment programs have not only led to a continuously growing debt, but they have also led to a reduction in the income of the local population (as a result of the layoffs, the curtailment of public services, etc.) and price increases (as a result of increased VAT, liberalization of prices, etc.). 40

Notice how the policies of the IMF are aimed at financially milking the population through taxes, devaluation of the currency (a hidden form of taxation), foreign acquisition through privatizations, keeping the people dumb and uneducated by cutting in education, blocking wages in order to have cheap laborers for multinationals who settle here, etc. etc. This is the takeover of a country through the economy, as John Perkins describes in his book. It’s a new form of colonialism and ultimately we become nothing more than slaves.

The banks in Britain eventually applied a similar system to the USA through the introduction of an income tax and the “Federal Reserve Act” in 1913. In the USA a large part of the population thinks that they are independent, while in fact the world banks operating from Britain have taken over again since 1913 through an economic coup d’etat. For more on this, I refer you to the work by Jordan Maxwell. 41 42 43 44 45 Also read what Colonel Edward Mandell House told President Woodrow Wilson about this. 46

[Very] soon, every American will be required to register their biological property in a national system designed to keep track of the people and that will operate under the ancient system of pledging. By such methodology, we can compel people to submit to our agenda, which will effect our security as a chargeback for our fiat paper currency. Every American will be forced to register or suffer being unable to work and earn a living. They will be our chattel, and we will hold the security interest over them forever, by operation of the law merchant under the scheme of secured transactions.

Americans, by unknowingly or unwittingly delivering the bills of lading to us will be rendered bankrupt and insolvent, forever to remain economic slaves through taxation, secured by their pledges. They will be stripped of their rights and given a commercial value designed to make us a profit and they will be none the wiser, for not one man in a million could ever figure our plans and, if by accident one or two should figure it out, we have in our arsenal plausible deniability. After all, this is the only logical way to fund government, by floating liens and debt to the registrants in the form of benefits and privileges. This will inevitably reap to us huge profits beyond our wildest expectations and leave every American a contributor to this fraud which we will call “Social Insurance.” Without realizing it, every American will insure us for any loss we may incur and in this manner, every American will unknowingly be our servant, however begrudgingly. The people will become helpless and without any hope for their redemption and, we will employ the high office of the President of our dummy corporation to foment this plot against America.

It’s important to realize that it’s the same owners of the British East India Company, who wanted to impose taxes in America around 1767, that now stand behind the world banks. They are still trying to colonize and conquer countries but in a smarter, and more covert way. As I mentioned earlier, as long as people don’t know that they are slaves they won’t fight against the system.

The IMF and other world banks are responsible for the economic mess in many countries around the world. Recently the crisis in Greece, 47 and currently also in the USA, where exactly the same disastrous strategies are being implemented. 48 49 I encourage everyone to read about the details in the footnotes.

President Bouterse, you often say it yourself, but we live in an important time period right now, not only for us in Suriname, but for humanity in general. There are major changes taking place very rapidly around the world. According to Professor Michio Kaku we are in the process of making the transition from a Type 0 civilization (barbaric, selfish, revengeful) to a Type 1 or planetary civilization 50 (tolerant, highly developed), and that transition is generally not easy. It can be a very turbulent time, similar to growing pains. Our human consciousness also changes and we grow spiritually. According to Professor Kaku the Internet is technology that belongs to a Type 1 civilization. It is one of the basic requirements that makes a Type 1 civilization possible. He compares it to a global telephone system. But the Internet is more than that, it’s also a global knowledge base, it enables a planetary consciousness (“The Global Brain”). 51 52 53 54

At the beginning of this letter I expressed my disappointment about the fact that for hundreds, and even thousands, of years humankind has had the information to be able to solve many problems we have in the world today. It’s sad that the Americans knew all the way back in 1787 about the disastrous consequences taxes could have on their society, but that this knowledge was forgotten after only two generations, after which an income tax could still be introduced in 1913.

I think that in all those years the time wasn’t yet right for us to be able to do something with that knowledge, mainly because we didn’t yet have the Internet. Now that we have many terabytes of information and history at our fingertips through the Internet, it’s easy to analyze and compare problems along with others, to recognize patterns, to find causes and to look for solutions. And we can share all of that with the whole world within seconds. And because of the quick availability and easy accessibility of all this knowledge, even from hundreds of generations ago, chances are very slim that we’ll keep forgetting in the future. We can now finally learn without forgetting and we can avoid repeating mistakes even after many generations go by. History does not have to repeat itself anymore. 55

You are now in the position to be one of the first leaders in the world to do something positive with all the information in this letter. We must abandon this barbaric system of taxes that break down the individual, make him dependent and enslave him, and go to another system where the freedom, the independence and the rights of each individual are respected. Strong individuals form a strong society, just like individually strong links form a strong chain. The income and payroll taxes, and all taxes on property should be completely abolished. They are an attack on the individual, they weaken the individual, and the result of that is a weak society that can be heavily manipulated. In other countries, like the USA, they are already talking about getting off this system of taxes which gradually destroys a society from within. And not only do they talk about it, but the opposition continues to grow as more people “wake up” and realize what is really going on around them. 56 There is a large and constantly growing following behind Republican Ron Paul, despite the fact that the media, which are owned by the owners of the world banks, try their best to work against him.

It is now a global trend, mainly because of the “Global Brain,” that people “wake up” and get smarter and start to notice everything that’s wrong around us. This is especially the case among the younger generation; they will no longer tolerate that they are fooled, manipulated and enslaved by a small group of people. Your victory during the elections of 2010 is especially due to the younger generation. Similarly, despite the opposition, the Republican Ron Paul also enjoys tremendous support in the USA from the younger generation and the army 57 because of the solutions that he proposes.

In closing, I hope that based on this information you will take the necessary steps very soon to improve life for all of us. If we do nothing about this, then according to history only one fate awaits us.

With kind regards,

Karel Donk

http://www.kareldonk.com

Comments

There are 7 responses. Follow any responses to this post through its comments RSS feed. You can leave a response, or trackback from your own site.